Voluntary Protection Products

Program Objectives

Establish a Dealership-specific VPP Policy that addresses two key needs:

1. Optimized Product Penetration and Satisfied Customers

The model policy is designed to optimize your VPP program’s revenue-generating capabilities and encourage fair dealings for all parties to the transaction.

2. Regulatory Compliance

The model policy will increase your ability to withstand the inevitable oversight of all phases of VPP transactions if your program is targeted by a regulatory agency.

The VPP Program Coordinator

...possibly a corporate compliance officer or GM – works with management to reach a consensus on the custom policy for each section. After completing all eight sections, the VPP Program Coordinator submits the custom policy to AFIP for formatting into a draft policy for review and approval by dealership management.

The final draft will be presented to the dealer’s legal counsel for review. The sign-off by legal counsel, affirming that the program conforms to the model VPP policy and state law, will satisfy the final implementation requisite of the AFIP VPP program.

NADA/NAMAD/AIADA Voluntary Protection Products:

A Model Dealership Policy

Published in 2019 in anticipation of heightened federal scrutiny of voluntary protection products, the policy addresses the key areas of concern voiced by regulators.

Regulators were concerned about dealers charging for products of no real value (junk fees), not being transparent about the optional nature of products and how they impact the vehicle purchase, disparate pricing and charging exorbitant prices that aren’t commensurate with actual value, among others.

The model Voluntary Protection Product policy encompasses the entire life cycle of the VPP in the dealership in eight sections:

- Policy Statement

- Legal Compliance, Training, Oversight, Coordination, Document Retention

- Product Selection

- Product Pricing

- Product Advertising

- Product Presentation and Sale

- Product Cancellation

- Customer Complaints

Program Delivery

AFIP provides live interactive implementation guidance for a dealer-designated VPP Program Coordinator and other impacted dealership personnel…in eight online sessions that align with the eight VPP policy sections…supported by step-by-step instructions, templates and resources, plus the support of an AFIP VPP Facilitator until the program is implemented.

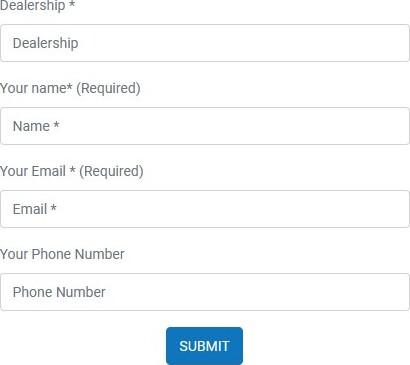

Contact Us To Learn More